Popular on TelAve

- Althea Gibson Honored as Final Release in U.S. Mint's American Women Quarters Program - 173

- Cyntexa Announces Updates to ChargeOn on Salesforce AppExchange

- Oklahoma and Starlink Local Installers getting it done! / now offering digital menu board installs

- Starlink Local Installers working with state of Minnesota (now offering digital menu board installs)

- Own 327 Acres of American Prime Real Estate with 2 Miles Waterfront Worth In Millions for Just $7 — Worldwide Raffle Launched

- Nebraska and Starlink Local Installers working together for reliable internet

- Starlink Local Installers helping Wisconsin stay wired (now offering digital menu board installs)

- Dr. Alexander Eastman Returns to Suburban Hospital to Deliver Keynote on Crisis Leadership

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- The 7 Visibility Problems Costing Independent Hotels Thousands Every Month

Similar on TelAve

- eJoule Inc Participates in Silicon Dragon CES 2026

- HBZBZL Unveils "Intelligent Ecosystem" Strategy: Integrating AI Analytics with Web3 Incubation

- Kaltra Launches Next-Gen MCHEdesign With Full Integration Into MCHEselect — Instant Simulation & Seamless Microchannel Coil Workflow

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Russellville Huntington Learning Center Expands Access to Literacy Support; Approved Provider Under Arkansas Department of Education

- UK Financial Ltd Launches U.S. Operations Following Delaware Approval

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

$283.2 Million; $1.40 Per Share in Revenue Reported for 2024 Fueling Impressive 96% Growth for High Tech AI Boosted Marketing Company: iQSTEL $IQST

TelAve News/10858578

iQSTEL, Inc. (Stock Symbol: IQST) $IQST Also Signs MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Plus $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - TelAve -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

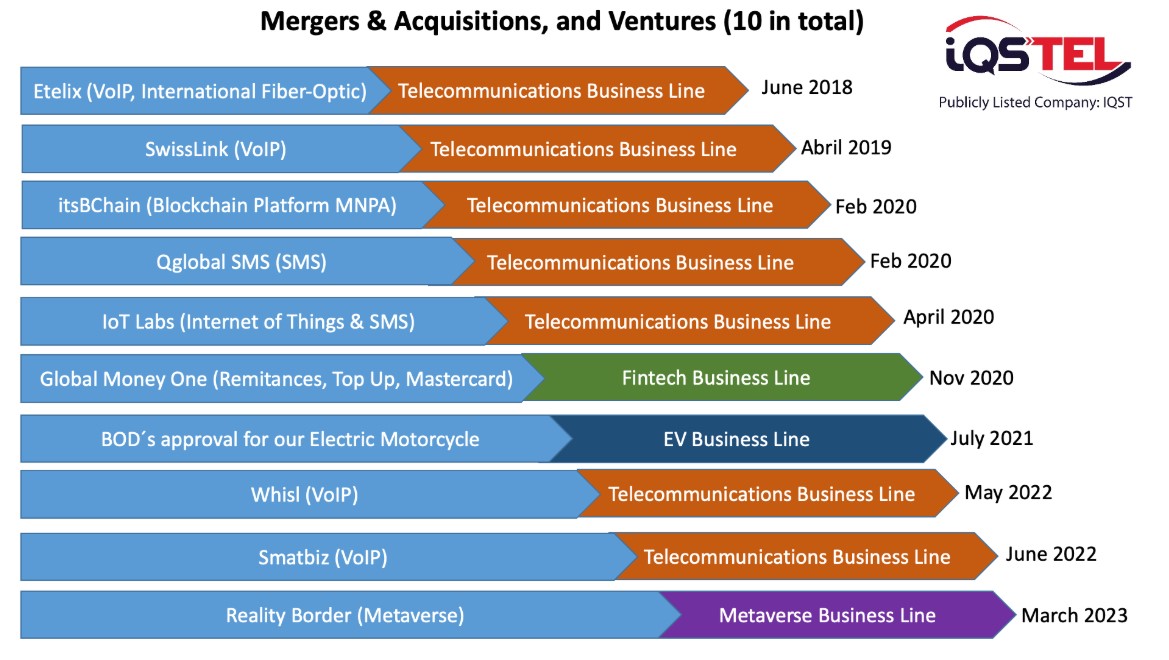

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on TelAve News

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on TelAve News

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on TelAve News

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- Documentary "Prescription for Violence: Psychiatry's Deadly Side Effects" Premieres, Exposes Link Between Psychiatric Drugs and Acts of Mass Violence

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on TelAve News

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Leimert Park Announces Weeklong Kwanzaa Festival & Kwanzaa Parade Celebrating Black History, Culture, and Community

- Renowned Alternative Medicine Specialist Dr. Sebi and His African Bio Mineral Balance Therapy Are the Focus of New Book

- Psychiatric Drug Damage Ignored for Decades; CCHR Demands Federal Action

- Why Millions Are Losing Sexual Sensation, And Why It's Not Age, Hormones, or Desire

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Technology, Telecom

0 Comments

Latest on TelAve News

- TRIO Heating, Air & Plumbing Now Ranks #1 in San Jose

- Milwaukee Job Corps Center Hosts Alumni Day, Calls Alumni to Action on Open Enrollment Campaign

- Golden Paper Identifies Global Growth in Packaging Papers and Upgrades Its High-End Production Capacity

- Champagne, Caviar Bumps & Pole Performances — Welcome the New Year Early with HandPicked Social Club

- A New Soul Album: Heart Of Kwanzaa, 7-Day Celebration

- Allegiant Management Group Named 2025 Market Leader in Orlando by PropertyManagement.com

- NAFMNP Awarded USDA Cooperative Agreement to Continue MarketLink Program Under FFAB

- Costa Oil - 10 Minute Oil Change Surpasses 70 Locations with Construction of San Antonio, TX Stores — Eyes Growth Via Acquisition or Being Acquired

- LaTerra and Respark Under Contract with AIMCO to Acquire a $455M, 7-Property Chicago Multifamily Portfolio

- Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

- VSee Health (N A S D A Q: VSEE) Secures $6.0M At-Market Investment, Accelerates Expansion as Revenues Surge

- Children Rising Appoints Marshelle A. Wilburn as New Executive Director

- Fairmint CEO Joris Delanoue Elected General Director of the Canton Foundation

- Sleep Basil Mattress Co.'s Debuts New Home Page Showcasing Performance Sleep Solutions for Active Denver Lifestyles

- Bent Danholm Joins The American Dream TV as Central Florida Host

- The Nature of Miracles Celebrates 20th Anniversary Third Edition Published by DreamMakers Enterprises LLC

- Artificial Intelligence Leader Releases Children's Book on Veterans Day

- Felicia Allen Hits #1 Posthumously with "Christmas Means Worship"

- CCHR Documentary Probes Growing Evidence Linking Psychiatric Drugs to Violence

- Creative Investment Research Warns AT&T Rollback Undermines Market Integrity