Popular on TelAve

- Community Redevelopment Inc.Signs Gold Production Contract with Mine CA Gold Ltd., - 175

- CCHR: Why Psychiatric Detainment and Drugging Cannot Deliver Public Safety - 162

- Two Weeks Left: Secure Your Spot at the First OpenSSL Conference 2025 in Prague - 161

- NFL Yearbook Advertising Deal Signed Across 25 Stadiums for AI Powered Sports, Entertainment and Gaming Leader: SEGG Media $SEGG - 154

- Olga Torres Named to the 2025 Texas Super Lawyers List - 149

- Boston Industrial Solutions Introduces Natron® UVPX Series UV-LED Curing Screen Printing Inks - 148

- Powerful Points Illustrate Highly Undervalued Stock Price for Global Communications Leader: IQSTEL, Inc. (N A S D A Q: IQST) - 146

- DB Landscape Co. Brings Modern Outdoor Living to Coastal Communities - 146

- PlaceBased Expands NYC Presence with Strategic DOOH/OOH Asset Growth and Appoints OOH Industry Veteran Scott Nemeroff as EVP of National Accounts - 145

- Award-Winning Motorcycle Documentary Angels Of Dirt Celebrates Women Racers Now Available Online - 142

Similar on TelAve

- WIBO Announces Fall 2025 Entrepreneurship Programs to Empower NYC Founders and Small Business Owners

- Wohler announces release of additional Balance Control output tracking for its eSeries in-rack monitor range

- A Milestone of Giving: Ten Percent Group Donates £25,000 to Cure Parkinson's

- Swidget Launches Luminance™ to Help Schools Achieve Alyssa's Law Compliance

- Phinge Mobile Pop-Up Stores Previewing Its Patented Modular Earbuds & Magnetically Connectable Phones, Tablets & Gaming Systems, Coming to Your Town

- MEDIA ADVISORY - Strengthening Children's Mental Health Across New Jersey

- NumberSquad Launches Year‑Round Tax Planning Package for Small Businesses and the Self‑Employed

- GlexScale launches a unified model for sustainable SaaS expansion across EMEA

- SwagHer Society Launches to Help Black Women Be Seen and Supported

- Zero-Trust Architecture: NJTRX Addresses 60% of U.S. Investors' Custody Security Concerns

IQSTEL, Inc. (N A S D A Q: IQST): Accelerating Toward $1 Billion Revenue with Disruptive AI & Fintech Innovations

TelAve News/10874084

$IQST is a Global Communications Leader Scaling with High-Tech, High-Margin Growth Strategy

CORAL GABLES, Fla. - TelAve -- IQSTEL, Inc. (N A S D A Q: IQST) is not just a telecom company anymore — it's emerging as a diversified technology powerhouse with bold ambitions and the roadmap to back them up.

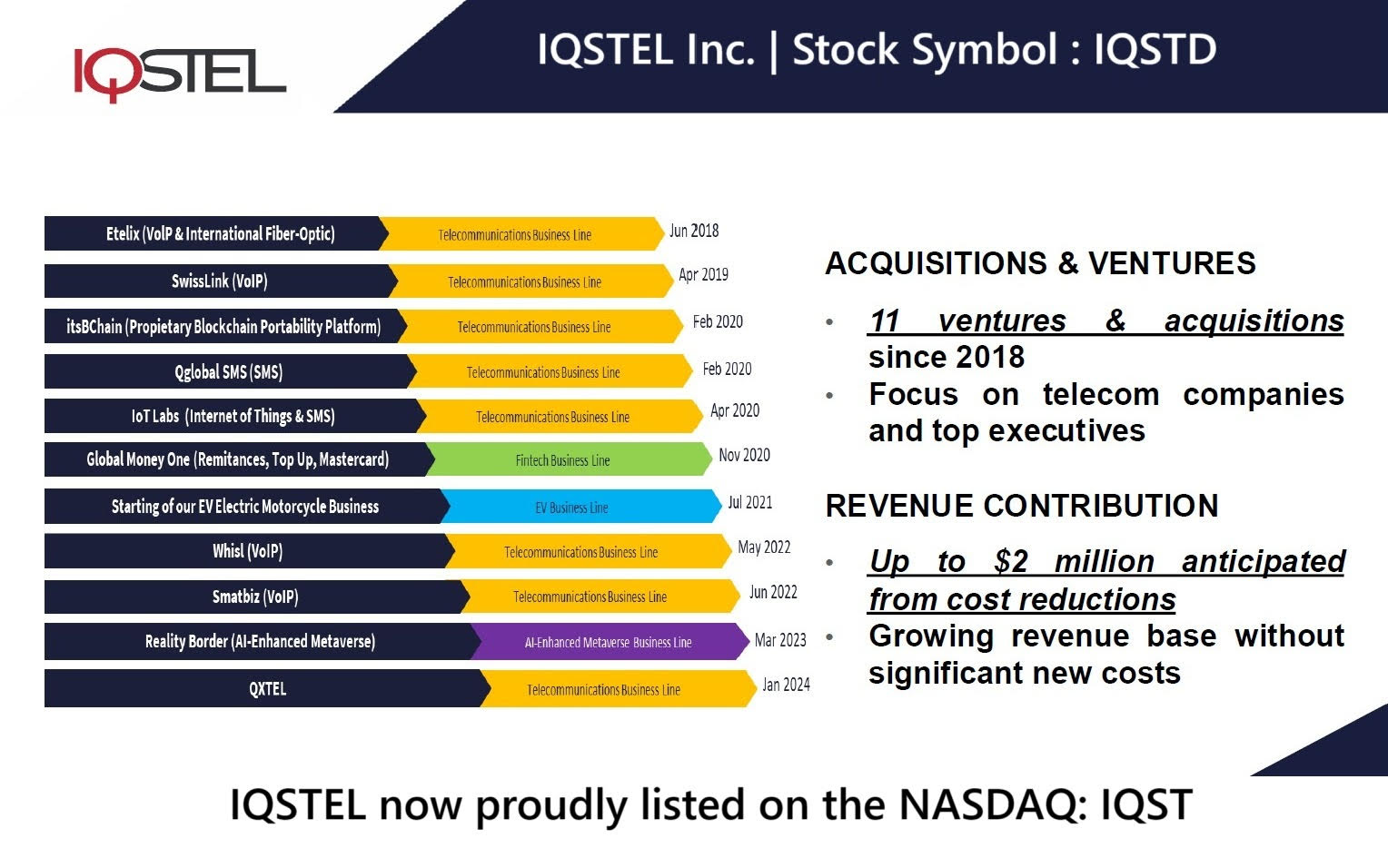

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

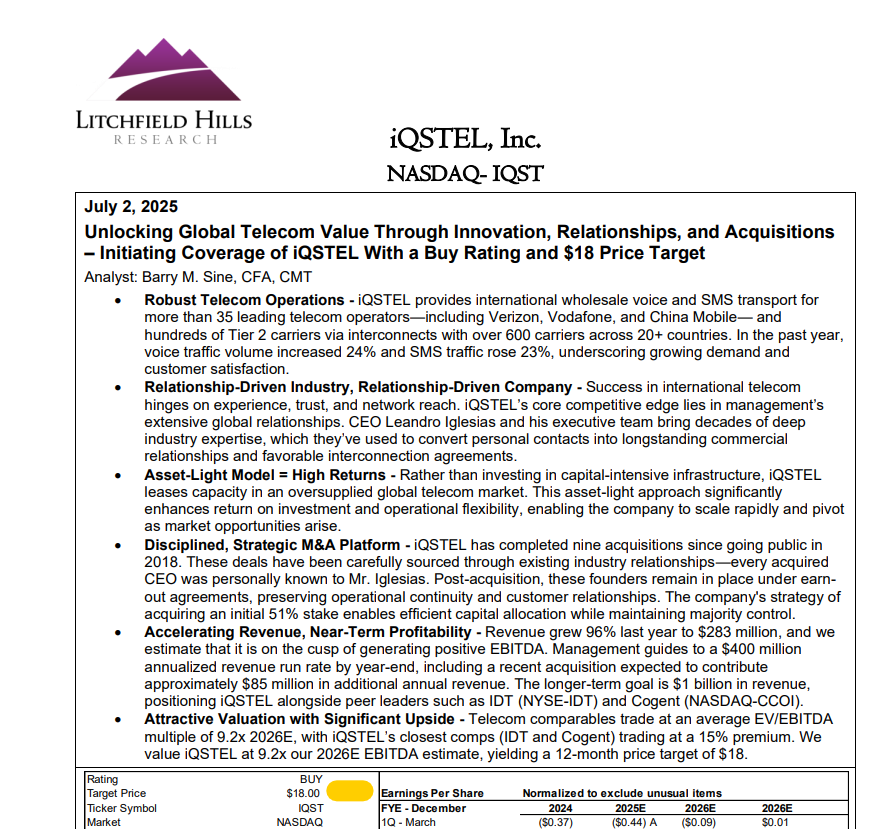

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on TelAve News

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on TelAve News

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

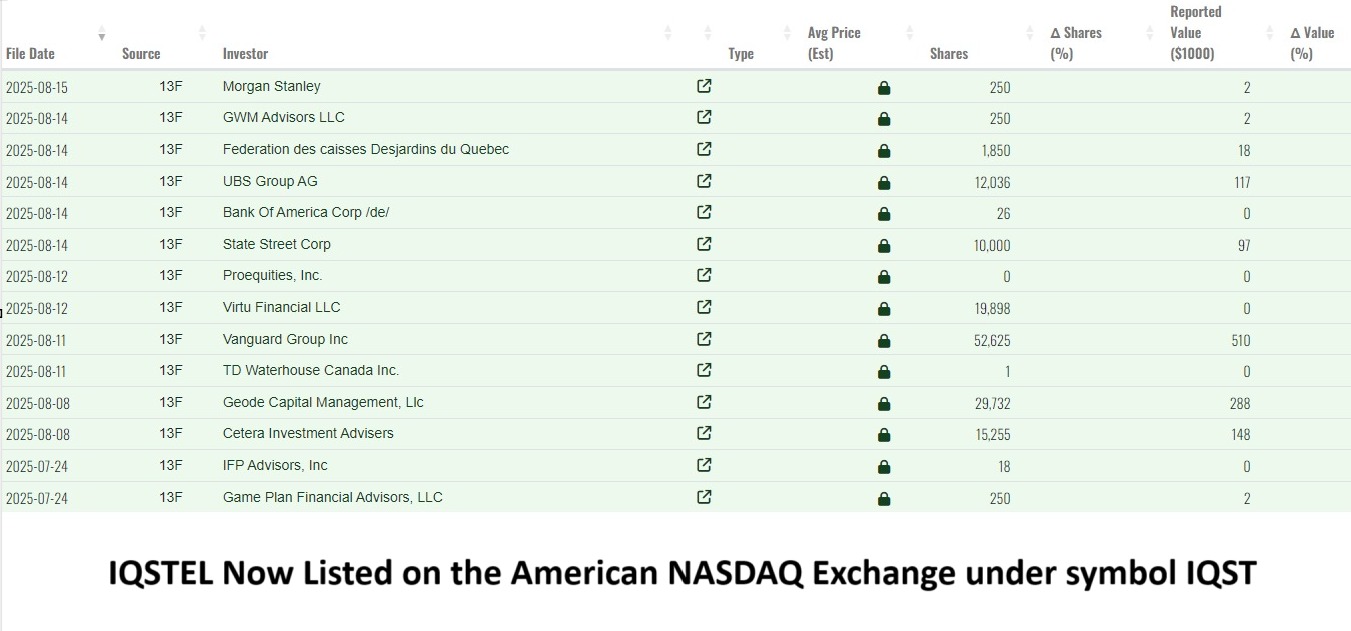

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on TelAve News

- Swidget Launches Luminance™ to Help Schools Achieve Alyssa's Law Compliance

- Growing Demand for EVA Mats Signals Shift in Car Interior Market

- MDRN MUSE Expands Insurance Network Coverage to Include Delta Dental & Cigna

- Hollywood In Pixels Celebrates the 8th Annual Silver Pixel Awards and Announces 2025 Campaign Pixel Winners Los Angeles, CA — Oct

- Phinge Mobile Pop-Up Stores Previewing Its Patented Modular Earbuds & Magnetically Connectable Phones, Tablets & Gaming Systems, Coming to Your Town

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

- 2025 – Build on the $400M revenue run rate, optimize for margins, and reduce debt.

- 2026 – Reach a $15M EBITDA run rate, triggering potential market capitalization of $150M–$300M based on standard EBITDA multiples.

- 2027 – Achieve $1B in revenue, positioning IQST among the top global tech leaders.

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

- Net Shareholder Equity: Grew from $11.9M to $14.29M (pre-July debt reduction).

- Gross Revenue: $155.15M in H1 2025, 17% YoY growth, fully organic.

- Gross Margin: Improved 7.45% YoY.

- Telecom Net Income: +29.94% QoQ.

- Adjusted EBITDA: $1.1 million for H1 2025.

- Assets per Share: $17.41 | Equity per Share: $4.84 (pre-debt cut).

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

- $34 million in revenue

- $260K in EBITDA in H2 2025

- Starting at $5M in July, scaling to $6M+ by December

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on TelAve News

- Physician Calls for States Nationwide to Ensure ADA Compliance in Independent Commissions

- MEDIA ADVISORY - Strengthening Children's Mental Health Across New Jersey

- Stop Paying Cloud Storage Fees: Make Money From Your Data That You Own, Through Netverse Verified App-less Platform & Hardware From Phinge

- NumberSquad Launches Year‑Round Tax Planning Package for Small Businesses and the Self‑Employed

- GlexScale launches a unified model for sustainable SaaS expansion across EMEA

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology, Telecom, Stocks, Financial, Artificial Intelligence, Cybersecurity

0 Comments

Latest on TelAve News

- $8 Billion High-Margin National Gentlemen's Club Market Targeted by Acquisition Strategy Incorporating the Successful Peppermint Hippo™ Brand: $TRWD

- Why Indian Game Development Companies Are Shaping the Future of Global Gaming

- Cold Storage and Proof-of-Reserves: BTXSGG Launches Institutional-Grade Asset Protection for Filipino Traders

- Redesigning the Digital World Around People, Not Algorithms: Netverse Verified, App-less Technologies, Platform and Hardware is Coming From Phinge

- Why FIRE Enthusiasts Are Buying Businesses Instead of Just Saving Their Way to Freedom

- All About bail Bonds Expands Presence to Serve Houston Families

- Thousands to Ride to L.A. Children's Hospital This Halloween Night

- Essential Living Support Opens First VA Medical Foster Home in Cheyenne, Wyoming

- Six-Figure Chicks Book Series 96 Authors, 6 Volumes Published to Empower and Mentor Women Nationwide

- LSC Destruction Launches Cutting-Edge Cryptocurrency Scanning to Hard Drive Destruction Services

- $150 Million Financing Initiates N A S D A Q's First Tether Gold Treasury Combining the Stability of Physical Gold with Blockchain $AURE

- Podcast for Midlife Women Entrepreneurs Celebrates 100th Episode with Rhea Lana's Founder and CEO

- What If Help Could Come Before the Fall?

- OddsTrader Examines the NHL Presidents Trophy Curse: Why Regular-Season Success Rarely Leads to Playoff Glory

- Bookmakers Review Launches Betting Insights on NBC's "The Voice: Battle of Champions"

- Coming Up this Weekend on CNBC Mike Milligan Joins Tom Hegna on "Financial Freedom with Tom Hegna"

- UK Website Launches "Toy Time Machine" — Find Your Childhood Christmas Toy in One Click

- $73.6M Pipeline, $10M Crypto Play & Legal Firepower: Why Investors Are Watching Cycurion (N A S D A Q: CYCU) Like a Hawk

- Grammy award-winning Cuban-Canadian artist Alex Cuba releases his 11th studio album, "Indole"

- Thread Advisory Group Launches to Help Retailers Turn Strategy Into Lasting Results