Popular on TelAve

- Still Using Ice? FrostSkin Reinvents Hydration

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- Cold. Clean. Anywhere. Meet FrostSkin

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Finland's €1.3 Billion Digital Gambling Market Faces Regulatory Tug-of-War as Player Protection Debate Intensifies

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

- François Arnaud, star of Heated Rivalry, is the real-life inspiration behind Christopher Stoddard's novel At Night Only

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- The Legal AI Showdown: Westlaw, Lexis, ChatGPT… or EvenSteven?

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

Similar on TelAve

- Scotch Whisky Market Dislocation Creates Compelling Entry Opportunity for Long-Term Investors

- $6 Million Funding Secured as Retail Expansion, Operational Streamlining, and Asset-Light Strategy Position the Company for Accelerated Growth $SOWG

- The "Unsexy" Business Quietly Creating 130+ New Entrepreneurs Across America — From Alaska to Puerto Rico

- Veteran Launches GTG Energy: Nicotine-Free Pouch as Americans Rethink Addiction, Focus, and What Fuels Performance

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- Energywise Solutions and Pickleball Pros Partner to Bring More Energy and Visibility to Pickleball Clubs

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

- The Franchise King® Releases Free Guide for Nervous Buyers

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

TelAve News/10883834

Off The Hook YS Inc. (NYSE American: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

WASHINGTON, N.C. - TelAve -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat market into a data-driven, institutional-grade platform—and investors are beginning to take notice.

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

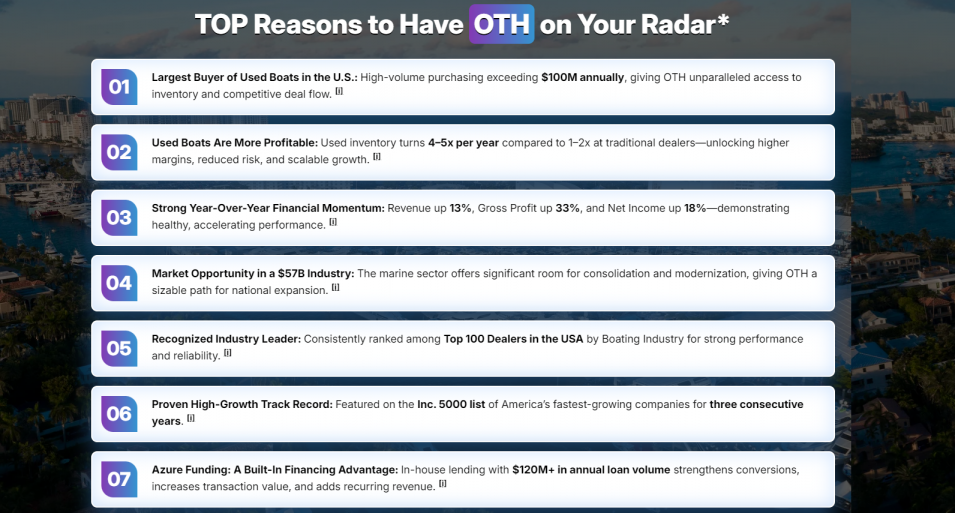

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on TelAve News

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

Nine-Month 2025 Highlights

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on TelAve News

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on TelAve News

- The "Unsexy" Business Quietly Creating 130+ New Entrepreneurs Across America — From Alaska to Puerto Rico

- Veteran Launches GTG Energy: Nicotine-Free Pouch as Americans Rethink Addiction, Focus, and What Fuels Performance

- RecallSentry™ App Launch — Your Home Safety Hub — Free on iOS & Android

- Award-Winning Director Crystal J. Huang's Under-$50K Film "The Ritual House" Wins Best Horror Feature at Golden State Film Festival

- Grads aren't getting hired — here's what we're doing about it

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Adjusted EBITDA of $0.5 million

- Net loss narrowed to $0.07 million

- Launch of Autograph Yacht Group, a luxury brokerage division

- Addition of 10 new brokers

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3%

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

- Adjusted EBITDA of $2.6 million

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on TelAve News

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- #WeAreGreekWarriors Comes to Detroit in Celebration of Women's History Month

- Energywise Solutions and Pickleball Pros Partner to Bring More Energy and Visibility to Pickleball Clubs

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

- The Franchise King® Releases Free Guide for Nervous Buyers

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

- Record revenues

- Rapid unit growth

- A national footprint

- AI-enabled operations

- A rare tax incentive tailwind

- And participation in a multi-decade growth industry

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

- BD Deep Investor Research Report (Dec. 8, 2025):

Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry

👉 https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf - Company Website: www.offthehookyachts.com

- Investor Media: https://compasslivemedia.com/oth/

- Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on TelAve News

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Danholm Collection Launches Boutique Luxury Real Estate Brokerage in Central Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- Food Journal Magazine Raises the Standard for Restaurant Reviews in Los Angeles

- Lunch24You Inc. Aligns Platform Development With Expanding School Nutrition Technology Markets

- Williamsville Spa Expands Team to Meet Growing Demand for Professional Facials

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards

- Jack and Sage Acquires Sustainable Apparel Brand Kastlfel, Expanding Premium Logo Wear Across National Parks and Ski Resorts

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026