Popular on TelAve

- Still Using Ice? FrostSkin Reinvents Hydration

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- Nest Finders Property Management Named #1 in Jacksonville and Ranked #99 Nationwide

- Half of Finnish Online Gambling Expenditure Now Flows to Offshore Instant Casinos as License Applications Open March 1, 2026

- Inkdnylon Simplifies Digitizing and Vector Art Nationwide With Clear Pricing and Guided File Support

- Market Value Enhancement From 2 Important New US Patents Issued for Strengthening Hair Enzyme Booster Technology to Caring Brands (NAS DAQ: CABR)

- Kaltra Expands Microchannel Innovation to Deliver Lower Refrigerant Charge

- EPP Pricing Platform announces leadership transition to support long-term growth and continuity

- P‑Wave Classics Launches Definitive New Edition of Hannah Webster Foster's The Coquette

- purelyIV Expands Concierge Wellness Platform with New IV Therapies, Memberships, and Digital Experience

Similar on TelAve

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

AI, Fintech, and Cybersecurity Divisions Ignite High-Margin Growth: IQSTEL, Inc. (N A S D A Q: IQST)

TelAve News/10882388

$430 Million 2026 Revenue Forecast for $IQST, 26% Organic Growth, and $500,000 Stock Dividend Highlight a Powerful AI & Digital Transformation Story

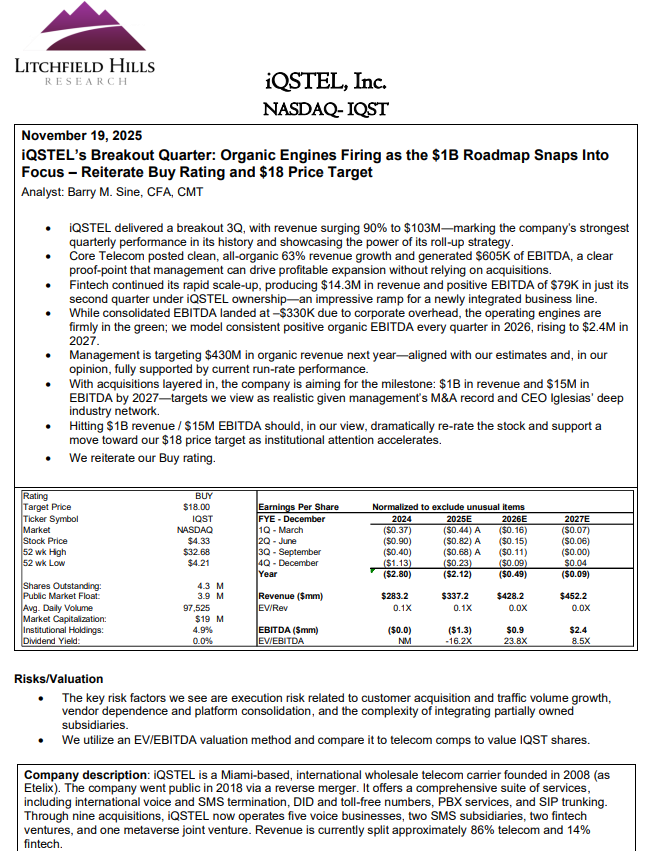

CORAL GABLES, Fla. - TelAve -- A new research report by Litchfield Hills sets an $18 price target on IQSTEL (N A S D A Q: IQST), citing the company's accelerating financial performance, a series of strategic acquisitions, breakthrough AI innovations, and the strongest balance sheet in its history. With a newly announced $430 million revenue forecast for 2026—reflecting 26% organic growth—IQSTEL is rapidly emerging as a global force in AI-powered telecommunications, fintech, and digital infrastructure.

Operating across 21 countries and serving more than 600 of the world's largest telecom carriers, IQSTEL has positioned itself at the intersection of telecom, artificial intelligence, financial technology, and next-generation cybersecurity. Already projected to generate $340 million in revenue for FY-2025, the company is now executing on a roadmap toward $15 million in EBITDA by 2026 and $1 billion in annual revenue by 2027.

A High-Growth, Debt-Free N A S D A Q Company Rewarding Shareholders in 2025

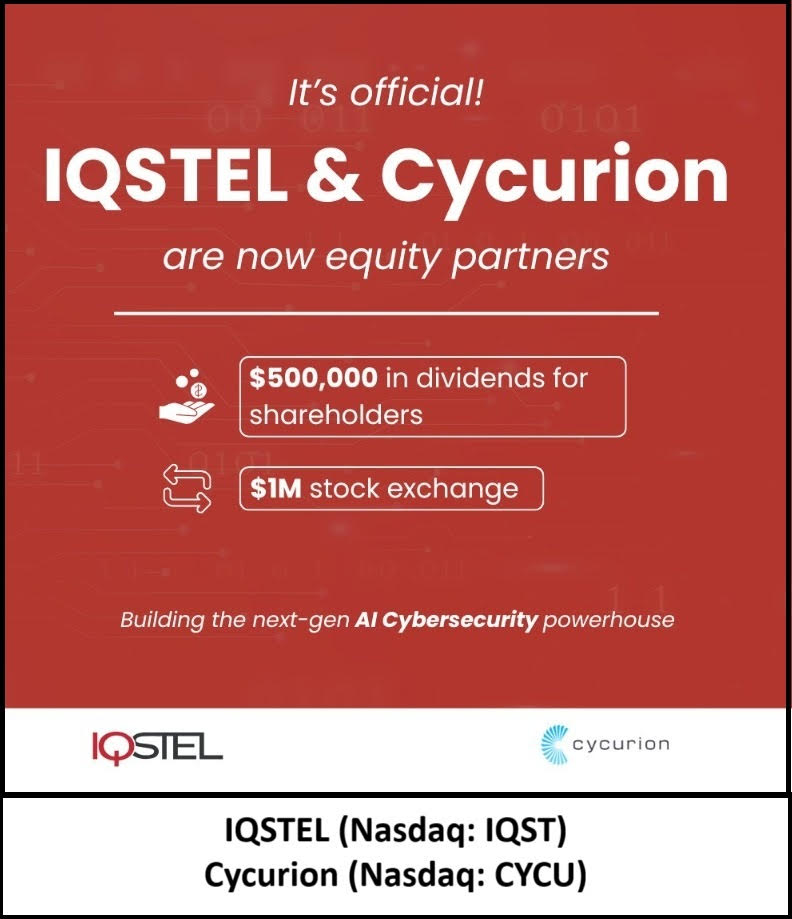

In one of its most shareholder-friendly moves to date, IQSTEL announced it has become a fully debt-free N A S D A Q company—eliminating all convertible notes and carrying zero warrants outstanding. At the same time, IQSTEL plans to distribute $500,000 in shares as a dividend to shareholders by year-end 2025, made possible through its strategic alliance and stock exchange with cybersecurity partner Cycurion (CYCU).

IQSTEL now boasts $17.41 in assets per share, strengthening investor confidence as the company accelerates high-margin revenue streams across AI, fintech, and cyber technologies.

Litchfield Hills Research Initiates Coverage: $18 Price Target

Litchfield Hills Research issued a detailed analytical report highlighting:

The firm's $18 price target underscores the potential for significant valuation expansion as IQSTEL continues delivering quarter-over-quarter performance improvements.

More on TelAve News

AI & Cybersecurity: New Era Begins with Cycurion Partnership and Phase One Launch

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its next-generation cyber defense program with Cycurion, Inc. (N A S D A Q: CYCU). The rollout introduces:

This strategic alliance positions IQSTEL to build one of the most secure AI ecosystems available to global telecom carriers and enterprise clients.

IQ2Call.ai Targets the $750 Billion Global Telecom Market

Fintech Division Surges with Globetopper: A Powerful EBITDA Driver

The July 1, 2025 acquisition of Globetopper is already outperforming expectations:

IQSTEL plans to leverage its existing 600+ telecom customers to rapidly scale Globetopper's fintech products globally.

This division is expected to play a central role in reaching the $15 million EBITDA run rate in 2026.

2026 Revenue Forecast Raised to $430 Million — All Organic, 26% Growth

IQSTEL reaffirmed its 2025 revenue forecast of $340 million, driven by growth across telecom, fintech, AI, and cybersecurity. With a flawless track record of meeting or exceeding forecasts, the company now projects:

Each acquisition will prompt an updated 2026 forecast, signaling potential for significantly larger revenue targets later in the year.

120 Days on N A S D A Q: Institutional Momentum and Global Expansion

IQSTEL's "120-Day Nasdaq Shareholder Letter" highlighted:

IQSTEL's clean, debt-free structure enhances its valuation profile while enabling expansion without financial overhang.

More on TelAve News

Building One of the World's Most Diversified Digital Infrastructure Companies

IQSTEL is now executing across four powerful verticals:

1. Telecommunications

Global carrier network with 600+ customers and consistent revenue backbone.

2. Fintech

Globetopper and emerging payment solutions integrated across IQST's telecom footprint.

3. Artificial Intelligence

AI call center solutions, AI agents, and vertical AI integration via IQ2Call and Airweb.

4. Cybersecurity

Next-generation cyber capabilities through the Cycurion alliance.

This integrated structure positions IQSTEL to become one of the most diversified AI-powered digital communications companies in the world.

A Company Moving With Speed, Innovation, and Execution Discipline

Investors and analysts alike are taking notice as IQSTEL continues to:

IQSTEL: A Transformational Leader in the Future of Telecom, AI, Fintech & Cybersecurity

With growing analyst coverage, a rapidly strengthening financial profile, and a suite of next-generation digital technologies, IQSTEL is positioned for what could be one of the strongest multi-year growth cycles in the small-cap tech sector.

For more information:

www.IQSTEL.com

www.landingpage.iqstel.com

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Operating across 21 countries and serving more than 600 of the world's largest telecom carriers, IQSTEL has positioned itself at the intersection of telecom, artificial intelligence, financial technology, and next-generation cybersecurity. Already projected to generate $340 million in revenue for FY-2025, the company is now executing on a roadmap toward $15 million in EBITDA by 2026 and $1 billion in annual revenue by 2027.

A High-Growth, Debt-Free N A S D A Q Company Rewarding Shareholders in 2025

In one of its most shareholder-friendly moves to date, IQSTEL announced it has become a fully debt-free N A S D A Q company—eliminating all convertible notes and carrying zero warrants outstanding. At the same time, IQSTEL plans to distribute $500,000 in shares as a dividend to shareholders by year-end 2025, made possible through its strategic alliance and stock exchange with cybersecurity partner Cycurion (CYCU).

IQSTEL now boasts $17.41 in assets per share, strengthening investor confidence as the company accelerates high-margin revenue streams across AI, fintech, and cyber technologies.

Litchfield Hills Research Initiates Coverage: $18 Price Target

Litchfield Hills Research issued a detailed analytical report highlighting:

- IQSTEL's rapidly expanding high-margin divisions

- Its clean balance sheet and institutional investor growth

- A diversified strategy that strengthens both revenue reliability and scalability

- A clear, credible path to $1B revenue within 36 months

The firm's $18 price target underscores the potential for significant valuation expansion as IQSTEL continues delivering quarter-over-quarter performance improvements.

More on TelAve News

- Arcuri Group Announces Long‑Term Partnership with WakeMed Health & Hospitals to Deliver Situational Awareness and De‑escalation Training

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

AI & Cybersecurity: New Era Begins with Cycurion Partnership and Phase One Launch

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its next-generation cyber defense program with Cycurion, Inc. (N A S D A Q: CYCU). The rollout introduces:

- Secure Model Context Protocol (MCP) integration

- AI agents (Airweb.ai and IQ2Call.ai) with embedded cyber defense

- Multi-layer ARx cybersecurity protection

- Real-time threat hunting for enterprise and telecom applications

This strategic alliance positions IQSTEL to build one of the most secure AI ecosystems available to global telecom carriers and enterprise clients.

IQ2Call.ai Targets the $750 Billion Global Telecom Market

Fintech Division Surges with Globetopper: A Powerful EBITDA Driver

The July 1, 2025 acquisition of Globetopper is already outperforming expectations:

- ~$16 million revenue contribution forecasted for Q3 2025

- ~$110,000 EBITDA in the same quarter

- Fully cash-flow positive

- Positioned to generate $34 million revenue across H2 2025

IQSTEL plans to leverage its existing 600+ telecom customers to rapidly scale Globetopper's fintech products globally.

This division is expected to play a central role in reaching the $15 million EBITDA run rate in 2026.

2026 Revenue Forecast Raised to $430 Million — All Organic, 26% Growth

IQSTEL reaffirmed its 2025 revenue forecast of $340 million, driven by growth across telecom, fintech, AI, and cybersecurity. With a flawless track record of meeting or exceeding forecasts, the company now projects:

- $430 million revenue in 2026

- 100% organic growth in the forecast

- Additional upside from 2–3 planned accretive acquisitions

Each acquisition will prompt an updated 2026 forecast, signaling potential for significantly larger revenue targets later in the year.

120 Days on N A S D A Q: Institutional Momentum and Global Expansion

IQSTEL's "120-Day Nasdaq Shareholder Letter" highlighted:

- Operations in 20+ countries

- Rapidly accelerating AI division, with multiple new contracts in its sales funnel

- 12 institutional investors now holding 4% of outstanding shares

- $35 million revenue in July alone—surpassing a $400M annual run rate

- $6.9 million in debt eliminated (~$2 per share value)

- Strengthened equity through voluntary conversion of investor debt into preferred shares

IQSTEL's clean, debt-free structure enhances its valuation profile while enabling expansion without financial overhang.

More on TelAve News

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- Talentica Announces Winners of Multi-Agent Hackathon 2026

Building One of the World's Most Diversified Digital Infrastructure Companies

IQSTEL is now executing across four powerful verticals:

1. Telecommunications

Global carrier network with 600+ customers and consistent revenue backbone.

2. Fintech

Globetopper and emerging payment solutions integrated across IQST's telecom footprint.

3. Artificial Intelligence

AI call center solutions, AI agents, and vertical AI integration via IQ2Call and Airweb.

4. Cybersecurity

Next-generation cyber capabilities through the Cycurion alliance.

This integrated structure positions IQSTEL to become one of the most diversified AI-powered digital communications companies in the world.

A Company Moving With Speed, Innovation, and Execution Discipline

Investors and analysts alike are taking notice as IQSTEL continues to:

- Hit revenue targets early

- Expand margins

- Add high-value acquisitions

- Deploy advanced AI and cybersecurity technology

- Strengthen its balance sheet

- Grow institutional ownership

- Reward shareholders with dividends

IQSTEL: A Transformational Leader in the Future of Telecom, AI, Fintech & Cybersecurity

With growing analyst coverage, a rapidly strengthening financial profile, and a suite of next-generation digital technologies, IQSTEL is positioned for what could be one of the strongest multi-year growth cycles in the small-cap tech sector.

For more information:

www.IQSTEL.com

www.landingpage.iqstel.com

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Technology, Telecom

0 Comments

Latest on TelAve News

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity

- Josh Stout "The Western Project"

- Open House Momentum Builds at Heritage at South Brunswick

- A Celebration of Visibility, Voice and Excellence: The 57th NAACP Image Awards Golf Invitational, Presented by Wells Fargo, A PGD Global Production

- Athens in Spring: A Culinary City Break That Rivals Paris and Copenhagen

- ClearSight Therapeutics Signs LOI with Covalent Medical for $60M Multi-Channel OTC Eye Care Partnership

- Jayne Williams Joins Century Fasteners Corp. Sales and Business Development Team

- Rocket Fibre Services Growing Customer Base With netElastic Networking Software

- Cummings Graduate Institute for Behavioral Health Studies Honors New Doctor of Behavioral Health Graduates

- IDpack v4 Launches: A Major Evolution in Cloud-Based ID Card Issuance

- CCHR Says Psychiatry's Admission on Antidepressant Withdrawal Comes Far Too Late

- 505 Plumbing, Heating & Cooling Launches in Albuquerque, Bringing a Customer-First Approach to Home Services

- As AI.com Sells For Record $70 Million, Attention Now Turns To ArtificialIntelligence.com

- ClearBeam Networks Launches HomeStation: Home Phone 2.0

- AOW Event Sponsored By The Stanglwirt Resort a renowned five-star Austrian wellness destination

- Average US gambler spends $210 per month in 2026