Popular on TelAve

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026 - 135

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

- Holiday Decorations Most Likely to Cause Injuries

- FreeTo.Chat - The bold, Anonymous Confession Platform, ushers in a new era of tension relief

- Creative Investment Research Warns AT&T Rollback Undermines Market Integrity

- Microgaming Unveils Red Papaya: A New Studio Delivering Cutting-Edge, Feature-Rich Slots

- Naturism Resurgence (NRE) Announces the World's First Standardised Stigma Measure (SSM) for Naturism

- Costa Oil - 10 Minute Oil Change Surpasses 70 Locations with Construction of San Antonio, TX Stores — Eyes Growth Via Acquisition or Being Acquired

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

Similar on TelAve

- Jones Sign Rebrands as Jones to Reflect Growth, Innovation, and Expanded Capabilities

- $1 Million Share Repurchase Signals Confidence as Off The Hook YS Scales a Tech-Driven Platform in the $57 Billion U.S. Marine Market

- Trends Journal's Top Trends of 2026

- CollabWait to Launch Innovative Waitlist Management Platform for Behavioral Health Services

- Imagen Golf Launches "Precision Lessons" with Trackman iO in Newtown, PA

- Adam Clermont Releases New Book – Profit Before People: When Corporations Knew It Was Dangerous and Sold It Anyway

- Revenue Optics Appoints Ljupco Icevski as Executive Advisor in Strategic Move to Accelerate Commercial Development

- Scoop Social Co. Partners with Air Canada to Celebrate New Direct Flights to Milan with Custom Italian Piaggio Ape Gelato Carts

- Breakout Phase for Public Company: New Partnerships, Zero Debt, and $20 Million Growth Capital Position Company for 2026 Acceleration

- Global License Exclusive Secured for Emesyl OTC Nausea Relief, Expanding Multi-Product Growth Strategy for Caring Brands, Inc. (N A S D A Q: CABR)

Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

TelAve News/10883242

Off The Hook YS Inc. (N Y S E American: OTH): Digital BD Deep Releases Comprehensive Research Report as OTH Prepares for December 15 Earnings Call

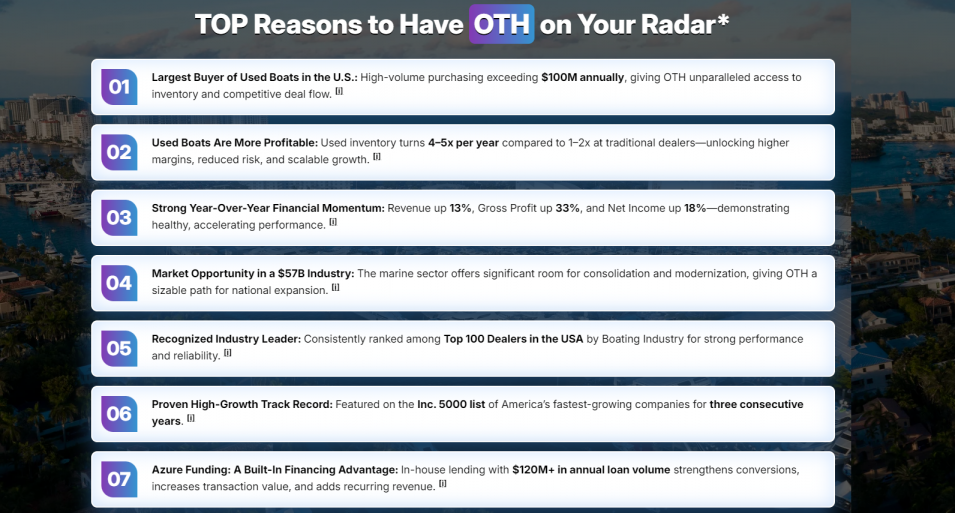

WASHINGTON, N.C. - TelAve -- Off The Hook YS Inc. (N Y S E American: OTH), one of America's largest buyers and sellers of pre-owned boats, is heading into year-end 2025 with accelerating momentum across its core business, a successful IPO behind it, and major new growth initiatives underway. With operations spanning the East Coast and South Florida, OTH acquires more than $100 million in boats and yachts each year and continues to scale its technology-driven platform to serve a U.S. marine industry valued at $57 billion.

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on TelAve News

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on TelAve News

Proceeds will be used to:

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

- Domestic Dial-In: (800) 715-9871

- International Dial-In: (646) 307-1963

- Passcode: 5863262

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on TelAve News

- Urban Bush Women Celebrates Bessie Award Nominations & Winter 2026 Touring

- Imagen Golf Launches "Precision Lessons" with Trackman iO in Newtown, PA

- New Report Reveals Surprising Trends in Illinois Airport Accidents

- PebblePad Acquires myday to Deliver Unified Digital Campus Experiences for Student Success

- Adam Clermont Releases New Book – Profit Before People: When Corporations Knew It Was Dangerous and Sold It Anyway

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on TelAve News

- "Big Tech is Not Talking About Everyone Owning, Controlling & Monetizing Their Own Data in the AI Future, but Phinge is," Says its CEO Robert DeMaio

- Dirty Heads, 311, Tropidelic, and The Movement to Headline Everwild Music Festival in 2026 with its largest lineup to date!

- The Stork Foundation Announces 2025 Year-End Impact and Grant Awards Amid Rising National Demand

- Stout Industrial Technology Appoints Paul Bonnett as Chief Executive Officer

- Revenue Optics Appoints Ljupco Icevski as Executive Advisor in Strategic Move to Accelerate Commercial Development

Proceeds will be used to:

- Support floorplan financing

- Expand marketing and advertising

- Repay a promissory note

- Strengthen working capital

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on TelAve News

- Lineus Medical Completes UK Registration for SafeBreak® Vascular

- Canyons & Chefs Announces Revamped Homepage

- $140 to $145 Million in 2026 Projected and Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry; N Y S E: OTH

- Really Cool Music Releases Its Fourth Single - "So Many Lost Years"

- MGN Logistics Acquires Fast Service LLC, Fueling MyMGN Marketplace Expansion and Supercharging Expedited Coverage Nationwide

- The Wait is Over: Salida Wine Festival Announces Triumphant 2026 Return After Seven-Year Hiatus

- Graduates With $40K in Student Debt Are Buying Businesses Instead of Taking Entry-Level Jobs

- Anne Seidman: Within the Lines

- How Democrats Made Healthcare More Expensive in 2026

- Inkdnylon Launches Bilingual Ask Inkdnylon Platform

- JS Gallery Brings Global Voices to LA Art Show 2026 with "OFF SCRIPT" Exhibition

- ANTOANETTA Partners With Zestacor Digital Marketing to Expand Online Presence for Handcrafted Luxury Jewelry

- FrostSkin Launches Kickstarter Campaign for Patent-Pending Instant-Chill Water Purification Bottle

- The New Monaco of the South (of Italy)

- Lick Personal Oils Introduces the Ultimate Valentine's Day Gift Collection for Romantic, Thoughtful Gifting

- Lacy Hendricks Earns Prestigious MPM® Designation from NARPM®

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Are You Hiring The Right Heater Repair Company in Philly?