Popular on TelAve

- EMBER™, the Only Standardized System Linking Workforce Identity to Growth, Appoints Global Brand Visionary Bret Sanford-Chung to Board of Directors - 229

- Iterators Named Preferred Accessibility Testing Vendor by MIT - 213

- OddsTrader Asks: What Are the Chances Your Team Makes the NFL Playoffs? - 211

- Phinge®, Home of Netverse® and Netaverse™ With Verified and Safer AI Announces "Test the Waters" Campaign for Potential Regulation A+ Offering - 209

- FreeTo.Chat Launches Silent Confessions, the Best Confession Site for Anonymous, Ad-Free Truth Sharing - 207

- Assent Joins AWS ISV Accelerate Program - 207

- Modernizing Pole Data Collection for Next-Gen Network Expansion - 205

- Contracting Resources Group Appears Again on the Inc. List of Fastest-Growing Companies - 205

- Sober.Buzz Adds Second Podcast, "Spreading the Good BUZZ" Guest List Grows, Numbers Continue Growing Globally, All While Josh and Heidi Tied the Knot - 204

- Heritage at South Brunswick Announces Two New Building Releases In Townhome Collection - 193

Similar on TelAve

- Charleston Hospitality Brings to Light the Advantage of Giving Back as a Growth Strategy

- $1.3 Billion Jackpot Fever Highlights Company Reentry to U.S. Lottery Market With Attractive New Rewards Program for AI Powered Entertainment Leader

- Revenue Optics Expands Leadership Team with Appointment of Pamela Sims as Strategic Marketing Advisor

- J3 Revenue Cycle Management Launches ForwardEHR Revolutionize Medical Practice Management through AI

- Boston Industrial Solutions Strengthens Leadership in Silicone Printing with Natron® and New Brands: SilTex® and Citrine®

- Employees learn to spot phishing with new Swiping Game

- NFL Week 1 Best Bets: Eagles-Cowboys Line Surges as Sharps Target Jaguars, Patriots, and More

- RUNWAY Transitions to RUNWAY Roots: Celebrating a Transformative Journey Towards Reparative Finance

- Wzzph Exchange's Comprehensive Whitepaper Details Web3-Powered Digital Asset Trading Platform and Strategic Ecosystem Development

- Next-Generation Website Launch Highlights New Growth Phase Including $10 Million Acquisitions Plan for AI Powered Sports, Entertainment, Gaming Leader

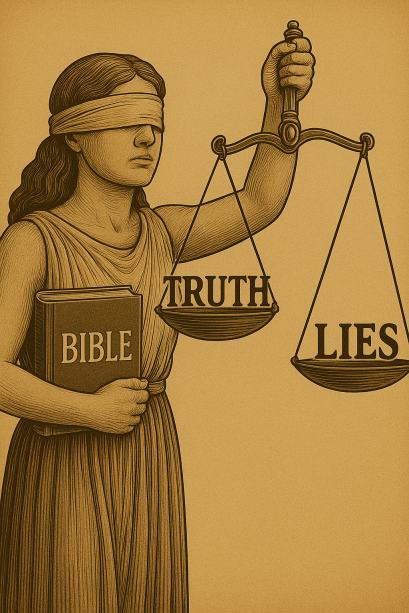

Myth Vs Fact, In Ricardo Salinas False Narrative Of USD $110 Million Loan Drama

TelAve News/10872465

The truth needs to be told when billionaire hijacks true facts

LONDON - TelAve -- Date: August 13, 2025**

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on TelAve News

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on TelAve News

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on TelAve News

- Technology veteran Bill Townsend releases shocking new book about AI

- Charleston Hospitality Brings to Light the Advantage of Giving Back as a Growth Strategy

- $1.3 Billion Jackpot Fever Highlights Company Reentry to U.S. Lottery Market With Attractive New Rewards Program for AI Powered Entertainment Leader

- Revenue Optics Expands Leadership Team with Appointment of Pamela Sims as Strategic Marketing Advisor

- "Hustler's Girl Remix" Delivers a Soulful Wake-Up Call to Hustlers Neglecting Love"

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on TelAve News

- J3 Revenue Cycle Management Launches ForwardEHR Revolutionize Medical Practice Management through AI

- ScaleFibre Launches SmartRIBBON™ High-Density Optical Fibre Cables

- Boston Industrial Solutions Strengthens Leadership in Silicone Printing with Natron® and New Brands: SilTex® and Citrine®

- Digital Watchdog Introduces COVA Hybrid NVRs

- Employees learn to spot phishing with new Swiping Game

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

Source: Astor Asset Management 3 Ltd

0 Comments

Latest on TelAve News

- Nashville International Chopin Competition Reflects on Global Summer, Unveils Fall & Winter Programs

- Phinge Invites Global Social Media Platforms & Major Brands To Join Netverse App-less Verified Platform To Reward & Safeguard Their Users & Customers

- Next-Generation Website Launch Highlights New Growth Phase Including $10 Million Acquisitions Plan for AI Powered Sports, Entertainment, Gaming Leader

- IQSTEL, Inc. (N A S D A Q: IQST): Accelerating Toward $1 Billion Revenue with Disruptive AI & Fintech Innovations

- Autohaus of Boston Launches Luxury Ferrari Winter Storage Experience

- New Wave Recovery Center Opens Comprehensive Addiction Treatment Facility in Salisbury, Massachusetts

- Dr. Sanjay Gupta's New Book Makes a Powerful Addition to Event Programming

- CCHR Warns Parents Must Guard Children from Subjective Mental Health Screening

- Keyanb Announces Launch of Next-Generation Crypto Exchange with 200,000 TPS Matching Engine and 94% Cold Storage Security

- Niufo Launches Next-Generation Crypto Exchange with Millisecond Trading and 98% Cold Storage Security

- GXCYPX Launches Next-Generation Crypto Exchange with 100,000+ TPS Matching Engine and Institutional-Grade Security

- New Scientific Study Reveals Why Humans Are Attracted to "Bad" Smells

- Ubleu Crypto Launches Advanced Trading Platform with Industry-Leading Security and Multi-Blockchain Support

- QFIA and Aparx Partner to Build Cross-Border Compliance Practice Platform, Second Course Officially Launches

- Fonteviva® Confirms U.S. Entry; E-Refer Sourcing Secures 10-Year Exclusive U.S. Importation & Distribution Rights

- Floridians Educated on Mental Health Abuses at the "Psychiatry: An Industry of Death" Traveling Exhibit in Orlando

- Nebuvex Exchange Announces Completion of Beta Testing, Prepares Q3 2025 US Market Launch

- Zoiko Orbit Launches: Seamless Global Travel Connectivity in 200+ Countries, Including Africa

- Transform Your Eyes: How to Lift Away Drooping or Hooded Eyelids

- The Other 95%: A Groundbreaking New Book Unlocks the Hidden Power of the Human Mind