Popular on TelAve

- Still Using Ice? FrostSkin Reinvents Hydration

- Nest Finders Property Management Named #1 in Jacksonville and Ranked #99 Nationwide

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- Half of Finnish Online Gambling Expenditure Now Flows to Offshore Instant Casinos as License Applications Open March 1, 2026

- Market Value Enhancement From 2 Important New US Patents Issued for Strengthening Hair Enzyme Booster Technology to Caring Brands (NAS DAQ: CABR)

- EPP Pricing Platform announces leadership transition to support long-term growth and continuity

- Ice Melts. Infrastructure Fails. What Happens to Clean Water?

- Luxury Lake-View Home Launches in Kissimmee's Bellalago community, Offering Privacy, Space, and Florida Resort-Style Living

- RTC Communications Completes Next Level Connect Fiber Expansion Bringing Multi-Gig Broadband to West Boggs Community

- Cold. Clean. Anywhere. Meet FrostSkin

Similar on TelAve

- Memelinked Social Media powered by cryptocurrency launching July 2026

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

Strategic Expansion with 3 New Alliances — Jefferson Beach Yacht Sales, CFR YS & flyExclusive Incentive Partnership: Off The Hook YS: (N Y S E: OTH)

TelAve News/10887360

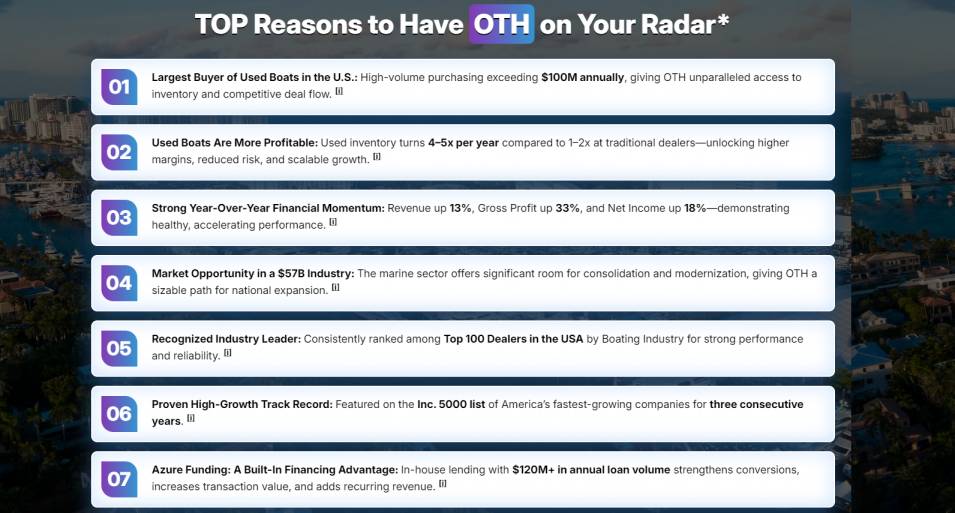

Off The Hook YS, Inc. (N Y S E: OTH) $OTH is Positioned for $140–$145 Million in 2026 Revenue with Technology-Driven Scale; Accelerating Global Expansion in the $57 Billion U.S. Marine Industry

WILMINGTON, N.C. - TelAve -- Off The Hook YS, Inc. (N Y S E: OTH) $OTH, one of America's largest buyers and sellers of pre-owned boats and yachts, is executing a disciplined growth strategy that combines technology-enabled transactions, strategic partnerships, and capital-efficient geographic expansion. Founded in 2012 and headquartered in Wilmington, North Carolina, OTH acquires over $100 million in boats and yachts annually and operates a nationwide platform spanning brokerage, wholesale, luxury sales, and marine finance.

Following its successful 2025 IPO, OTH has entered a new phase of expansion, extending its footprint into the Great Lakes of Michigan, the Caribbean, and Latin America, while strengthening inventory capacity, accelerating transaction velocity, and returning capital to shareholders.

Investment Highlights

Technology-Driven Operating Model

OTH's competitive advantage is anchored in a centralized, AI-enabled operating system that allows the Company to buy, sell, value, and finance vessels at scale. The platform integrates proprietary valuation tools, transaction analytics, and customer data to improve pricing accuracy, reduce holding periods, and accelerate deal execution.

More on TelAve News

This technology foundation enables OTH to operate as a national marketplace rather than a traditional dealership, allowing rapid expansion into new regions without replicating costly infrastructure.

Strategic Expansion into High-Value Regions

Great Lakes & Florida Expansion

Strategic Partnership with Jefferson Beach Yacht Sales

In February 2026, OTH announced a strategic partnership with Jefferson Beach Yacht Sales (JBYS), a premier Michigan-based brokerage with over 50 years of operating history and nine locations across the Great Lakes and Florida.

This partnership exemplifies OTH's strategy of leveraging established regional leaders to rapidly scale inventory flow and market reach.

Caribbean & Latin America Expansion

Strategic Agreement with CFR Yacht Sales (Puerto Rico)

In January 2026, OTH entered into a strategic agreement with CFR Yacht Sales, a leading brokerage based in San Juan, Puerto Rico, marking OTH's entry into the Caribbean and Latin American markets.

Under the agreement:

This expansion positions OTH to tap into a historically fragmented but high-value international market for pre-owned yachts.

Inventory Financing Expansion to Support Growth

In January 2026, OTH increased its inventory financing floorplan to $60 million, more than doubling capacity since its IPO. The expanded facility strengthens OTH's ability to acquire and carry high-quality inventory across multiple geographies.

Key benefits include:

Luxury Brokerage Momentum: Autograph Yacht Group

More on TelAve News

OTH's internally developed luxury division, Autograph Yacht Group, delivered strong momentum in Q4 2025.

Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins, powered by OTH's AI valuation engine and wholesale platform. This capability creates a structural advantage, improving liquidity, pricing confidence, and client experience in the high-end market.

Dealer Incentive Program with flyExclusive

To further scale acquisition volume, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive (NYSE American: FLYX), a leading private aviation operator.

The program:

Capital Allocation & Shareholder Value

In January 2026, OTH's Board authorized a $1 million share repurchase program, reflecting management's view that the Company's current valuation does not fully reflect its earnings power or long-term opportunity.

Management continues to balance:

Independent Research Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, highlighting the Company's scalable platform, growth trajectory, and differentiated technology.

Looking Ahead

With expanding geographic reach, a strengthened balance sheet, accelerating luxury brokerage momentum, and a technology platform designed for scale, Off The Hook YS, Inc. is positioning itself as a category-defining consolidator in the global pre-owned marine market.

For more information, visit:

www.offthehookyachts.com

https://compasslivemedia.com/oth/

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its successful 2025 IPO, OTH has entered a new phase of expansion, extending its footprint into the Great Lakes of Michigan, the Caribbean, and Latin America, while strengthening inventory capacity, accelerating transaction velocity, and returning capital to shareholders.

Investment Highlights

- Scaled Market Leader: One of the largest U.S. buyers and sellers of pre-owned boats, with over $100 million in annual acquisitions

- Large, Growing Market: Operating within a $57 billion U.S. marine industry, supported by favorable long-term demand trends

- Technology Advantage: AI-assisted valuation and data-driven transaction platform

- Capital-Efficient Expansion: Geographic growth achieved primarily through strategic partnerships rather than fixed brick-and-mortar investments

- Strong Financial Momentum: Record revenue of $82.6 million through the first nine months of 2025 (+19.3% YoY)

- 2026 Revenue Outlook: Management projects $140–$145 million in annual revenue

- Shareholder Alignment: Authorized $1 million share repurchase program reflects confidence in intrinsic value

Technology-Driven Operating Model

OTH's competitive advantage is anchored in a centralized, AI-enabled operating system that allows the Company to buy, sell, value, and finance vessels at scale. The platform integrates proprietary valuation tools, transaction analytics, and customer data to improve pricing accuracy, reduce holding periods, and accelerate deal execution.

More on TelAve News

- Serina Damesworth Hired as Century Fasteners Corp. – Director of Quality

- Pager Call Systems Joins The Brighton Technologies Group Family

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

This technology foundation enables OTH to operate as a national marketplace rather than a traditional dealership, allowing rapid expansion into new regions without replicating costly infrastructure.

Strategic Expansion into High-Value Regions

Great Lakes & Florida Expansion

Strategic Partnership with Jefferson Beach Yacht Sales

In February 2026, OTH announced a strategic partnership with Jefferson Beach Yacht Sales (JBYS), a premier Michigan-based brokerage with over 50 years of operating history and nine locations across the Great Lakes and Florida.

- OTH receives a right of first refusal on 100% of JBYS yacht trades

- Creates a high-velocity pipeline of pre-owned inventory

- Provides immediate access to key freshwater and seasonal markets

- Enables expansion without incremental staffing or dealership buildouts

This partnership exemplifies OTH's strategy of leveraging established regional leaders to rapidly scale inventory flow and market reach.

Caribbean & Latin America Expansion

Strategic Agreement with CFR Yacht Sales (Puerto Rico)

In January 2026, OTH entered into a strategic agreement with CFR Yacht Sales, a leading brokerage based in San Juan, Puerto Rico, marking OTH's entry into the Caribbean and Latin American markets.

Under the agreement:

- OTH gains preferred access to select pre-owned vessels generated through CFR's brokerage and trade activity

- CFR supports sourcing, verification, logistics, and regional wholesale visibility

- OTH gains access to brokerage facilities and inventory without direct capital investment

This expansion positions OTH to tap into a historically fragmented but high-value international market for pre-owned yachts.

Inventory Financing Expansion to Support Growth

In January 2026, OTH increased its inventory financing floorplan to $60 million, more than doubling capacity since its IPO. The expanded facility strengthens OTH's ability to acquire and carry high-quality inventory across multiple geographies.

Key benefits include:

- Broader inventory selection across price points and regions

- Faster turn times and improved conversion rates

- Increased transaction velocity supported by AI-driven matching tools

- Enhanced margin opportunities through vertically integrated services, including financing, insurance, warranties, and ancillary offerings

Luxury Brokerage Momentum: Autograph Yacht Group

More on TelAve News

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- March Is Skiing's Smartest Buying Window

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

OTH's internally developed luxury division, Autograph Yacht Group, delivered strong momentum in Q4 2025.

- Secured $100 million in luxury listings since launch

- Closed 22 transactions totaling $35 million

- Focused on yachts ranging from $500,000 to $20 million+

Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins, powered by OTH's AI valuation engine and wholesale platform. This capability creates a structural advantage, improving liquidity, pricing confidence, and client experience in the high-end market.

Dealer Incentive Program with flyExclusive

To further scale acquisition volume, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive (NYSE American: FLYX), a leading private aviation operator.

The program:

- Rewards high-performing dealer partners with private aviation flight hours

- Strengthens dealer loyalty and engagement

- Accelerates inventory intake and transaction volume

- Differentiates OTH's platform through premium, performance-based incentives

Capital Allocation & Shareholder Value

In January 2026, OTH's Board authorized a $1 million share repurchase program, reflecting management's view that the Company's current valuation does not fully reflect its earnings power or long-term opportunity.

Management continues to balance:

- Investment in inventory and technology

- Strategic partnerships and geographic expansion

- Disciplined capital returns to shareholders

Independent Research Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, highlighting the Company's scalable platform, growth trajectory, and differentiated technology.

Looking Ahead

With expanding geographic reach, a strengthened balance sheet, accelerating luxury brokerage momentum, and a technology platform designed for scale, Off The Hook YS, Inc. is positioning itself as a category-defining consolidator in the global pre-owned marine market.

For more information, visit:

www.offthehookyachts.com

https://compasslivemedia.com/oth/

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on TelAve News

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions

- Postmortem Pathology Expands Independent Autopsy Services in Kansas City

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity