Popular on TelAve

- Zoiko Orbit Launches: Seamless Global Travel Connectivity in 200+ Countries, Including Africa - 883

- ScaleFibre Launches SmartRIBBON™ High-Density Optical Fibre Cables - 589

- Autohaus of Boston Launches Luxury Ferrari Winter Storage Experience - 457

- New Analysis Reveals the Complex Forces Driving the 'Great Human Reshuffle' - 392

- IQSTEL, Inc. (N A S D A Q: IQST): Accelerating Toward $1 Billion Revenue with Disruptive AI & Fintech Innovations - 363

- Phinge To Offer All Third Party Platforms On Netverse The Ability To Run Instant Deals Automatically To Increase Sales During Slow Parts Of The Day - 324

- Starlink Local Installers offers national Starlink installations! - 312

- Phinge Asked Google AI, How Could Netverse Disrupt Crypto Like Bitcoin? Its Answer Might Shock You - 287

- Copper Mountain Technologies Introduces Affordable New VTR0102 and VTR0302 VNAs - 284

- Phinge Invites Global Social Media Platforms & Major Brands To Join Netverse App-less Verified Platform To Reward & Safeguard Their Users & Customers - 272

Similar on TelAve

- HuskyTail Digital Marketing Rings in Fall with Free SEO Audits for Local Businesses

- $750 Million Market Projected to Reach $3.35 Billion; Huge Opportunity for Superior Preservative-Free Ketamine Drug Treating Suicidal Depression $NRXP

- €6.4 Million in Contracts Across Multiple Countries; Smart City Developer; U.S. Expansion, and Announces Strategic Drone Tech Partnership; $AFFU

- CRYPTOCURRENCY: Lucrumia Exchange Platform Addresses Italian Traders' Growing Demand for Secure Digital Asset Trading

- NIUFO Launches Secure Trading Platform for Italian Market Seeking Stability After 20% User Decline

- OrderDomains.com Empowers Businesses with Premium Domains and Flexible Financing

- Cryptocurrency Trading: AHRFD Enters German Market with Institutional-Grade Infrastructure

- TSWHZC Launches Automated Copy Trading Platform for Brazil's 28 Million Crypto Users

- Keyanb Crypto Exchange Unveils Comprehensive Platform Architecture for Chilean Traders Seeking Lower Fees and Enhanced Security

- Phoenix Advocacy Network Launches to Amplify Survivor Voices and Advance Disability Rights

Val Sklarov Sets the Record Straight on the Astor Loan with Ricardo Salinas

TelAve News/10872471

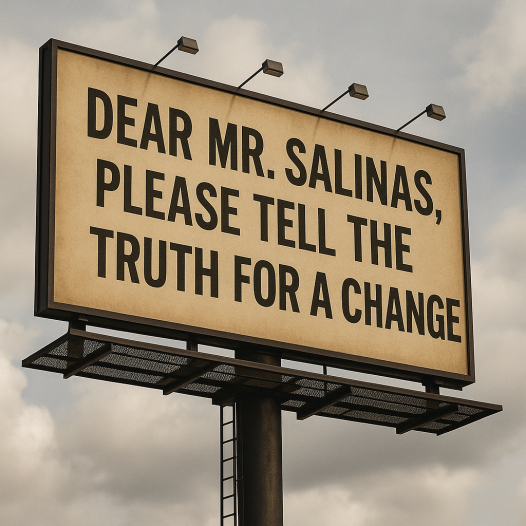

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - TelAve -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on TelAve News

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on TelAve News

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on TelAve News

- New Frontier Aerospace Appoints Industry Veteran Rich Pournelle as Director of Business Development

- AI's Urgent Energy Requirements Won't Be Solved By Trillions Of Dollars. Phinge's Patented App-Less Netverse Platform & Hardware Will Reduce This Need

- $750 Million Market Projected to Reach $3.35 Billion; Huge Opportunity for Superior Preservative-Free Ketamine Drug Treating Suicidal Depression $NRXP

- €6.4 Million in Contracts Across Multiple Countries; Smart City Developer; U.S. Expansion, and Announces Strategic Drone Tech Partnership; $AFFU

- CRYPTOCURRENCY: Lucrumia Exchange Platform Addresses Italian Traders' Growing Demand for Secure Digital Asset Trading

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on TelAve News

- NIUFO Launches Secure Trading Platform for Italian Market Seeking Stability After 20% User Decline

- OrderDomains.com Empowers Businesses with Premium Domains and Flexible Financing

- Cryptocurrency Trading: AHRFD Enters German Market with Institutional-Grade Infrastructure

- TSWHZC Launches Automated Copy Trading Platform for Brazil's 28 Million Crypto Users

- Keyanb Crypto Exchange Unveils Comprehensive Platform Architecture for Chilean Traders Seeking Lower Fees and Enhanced Security

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

0 Comments

Latest on TelAve News

- The World's No.1 Superstar™ Unveils Fall Lineup With the Re-Release of Holiday Classics

- Building A Business Website That Works In 2025

- The Law Offices of Steinhardt, Siskind and Lieberman, LLC Celebrates 35 Years

- University of Central Florida: "Psychiatry: An Industry of Death" Traveling Exhibit Educates Students on Mental Health Abuse

- LA's Rich & Successful Film Festival Celebrates Sold-Out Fourth Annual Edition

- New Jersey Therapy & Life Coaching Launches "Four Paws, Big Hearts" Fundraiser for Canine Companions

- AGDS Announces ALICE360 ProView EVO™

- Crossroads4Hope to Host Inspiring Hope Gala October 8, 2025

- LEDI Announces 2025 International Life Changers Awards Gala

- Who Will Win the 2025 Video Game of the Year? Bookmakers Review Shares Latest Odds

- International Gaming Platform Launch and Plans to Acquire Racing Women LTD. for AI Powered Sports, Entertainment and Gaming Leader: SEGG Media: $SEGG

- FDA Approval of Suitability Petition on Preservative-Free Ketamine Drug Supports $40 Analyst Target; $3 Billion Suicidal Depression Market: $NRXP

- U.S. Army Orders and Grant Initiative; Key Presentations at Tough Stump Rodeo & Tactical Assault Kit Events for Powerful Video Compression Tech: $RMXI

- Cervey, LLC and PharmaCentra, LLC Announce Strategic Partnership to Expand Pharmacy Technology Support Across Specialty Pharmacy and PBM Services

- Boston Industrial Solutions Introduces Natron® UVPX Series UV-LED Curing Screen Printing Inks

- OddsTrader Releases Latest NBA Finals Odds: Who's the Best Bet to Win in 2026?

- Planetary Constitution Celebrates First Anniversary as Space Policy Shifts Toward Militarization

- DB Landscape Co. Brings Modern Outdoor Living to Coastal Communities

- Alyrica Networks & Rural Prosperity Partners Secure Preliminary BEAD Award for Central Linn SD

- KeysCaribbean Offers 15 Percent Off Luxury Accommodations With Advance Purchase Rate Discount