Popular on TelAve

- Zoiko Orbit Launches: Seamless Global Travel Connectivity in 200+ Countries, Including Africa - 883

- ScaleFibre Launches SmartRIBBON™ High-Density Optical Fibre Cables - 589

- Autohaus of Boston Launches Luxury Ferrari Winter Storage Experience - 457

- New Analysis Reveals the Complex Forces Driving the 'Great Human Reshuffle' - 392

- IQSTEL, Inc. (N A S D A Q: IQST): Accelerating Toward $1 Billion Revenue with Disruptive AI & Fintech Innovations - 363

- Phinge To Offer All Third Party Platforms On Netverse The Ability To Run Instant Deals Automatically To Increase Sales During Slow Parts Of The Day - 324

- Starlink Local Installers offers national Starlink installations! - 312

- Phinge Asked Google AI, How Could Netverse Disrupt Crypto Like Bitcoin? Its Answer Might Shock You - 287

- Copper Mountain Technologies Introduces Affordable New VTR0102 and VTR0302 VNAs - 284

- Phinge Invites Global Social Media Platforms & Major Brands To Join Netverse App-less Verified Platform To Reward & Safeguard Their Users & Customers - 272

Similar on TelAve

- Lineus Medical Obtains CE Mark for Flagship Product SafeBreak Vascular

- Sine Nomine Associates: OpenAFS Google Summer of Code projects have been completed

- HuskyTail Digital Marketing Rings in Fall with Free SEO Audits for Local Businesses

- David White DDS Advances Implant Dentistry with New Technology Acquisition

- Final Countdown: The OpenSSL Conference 2025 Begins in One Week

- $750 Million Market Projected to Reach $3.35 Billion; Huge Opportunity for Superior Preservative-Free Ketamine Drug Treating Suicidal Depression $NRXP

- €6.4 Million in Contracts Across Multiple Countries; Smart City Developer; U.S. Expansion, and Announces Strategic Drone Tech Partnership; $AFFU

- CRYPTOCURRENCY: Lucrumia Exchange Platform Addresses Italian Traders' Growing Demand for Secure Digital Asset Trading

- NIUFO Launches Secure Trading Platform for Italian Market Seeking Stability After 20% User Decline

- OrderDomains.com Empowers Businesses with Premium Domains and Flexible Financing

$1 Billion Revenue Target, $15M EBITDA Run Rate Plan, and a Breakout Moment for This Global Tech Powerhouse: IQSTEL, Inc. (N A S D A Q: IQST):

TelAve News/10873395

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

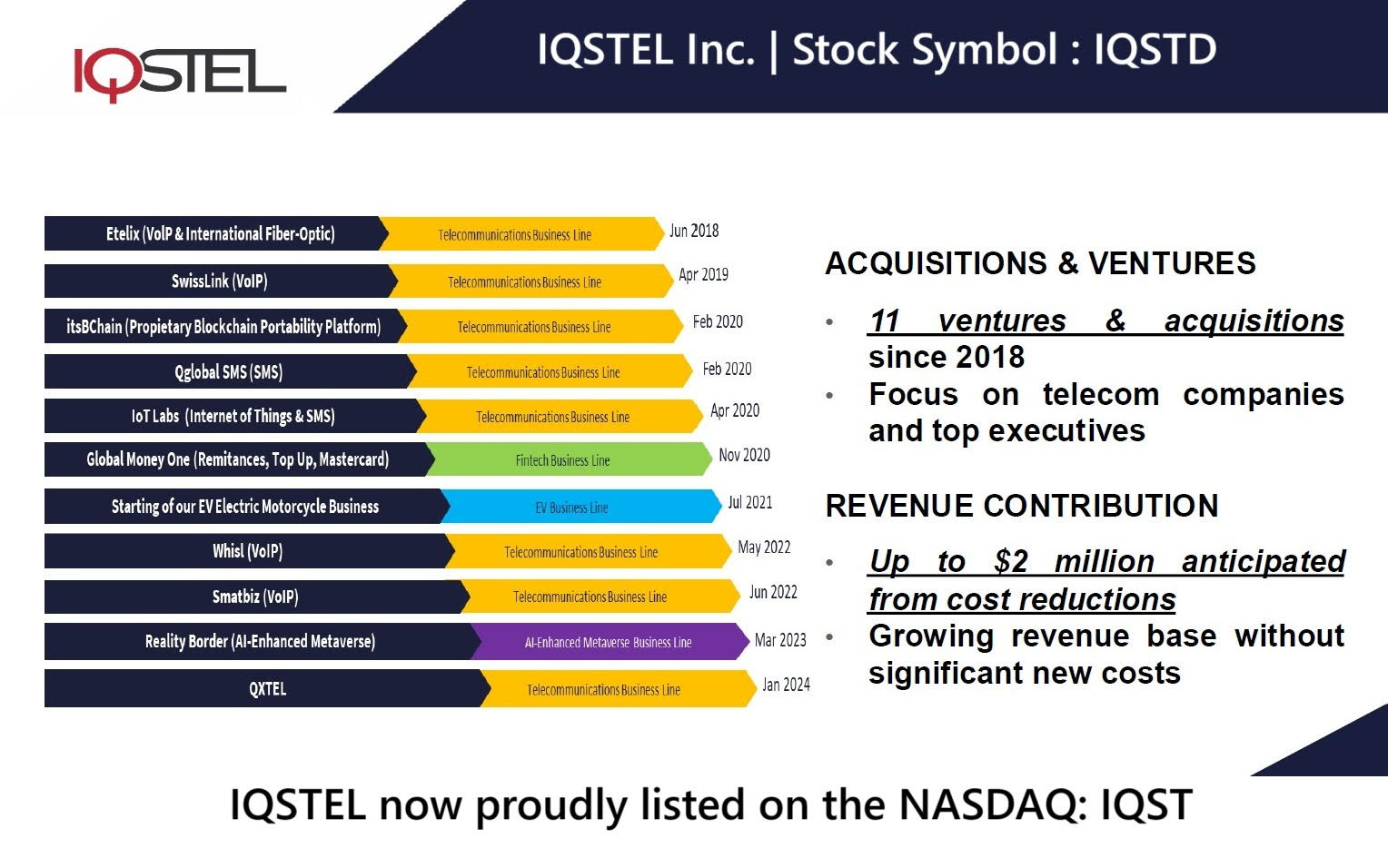

CORAL GABLES, Fla. - TelAve -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

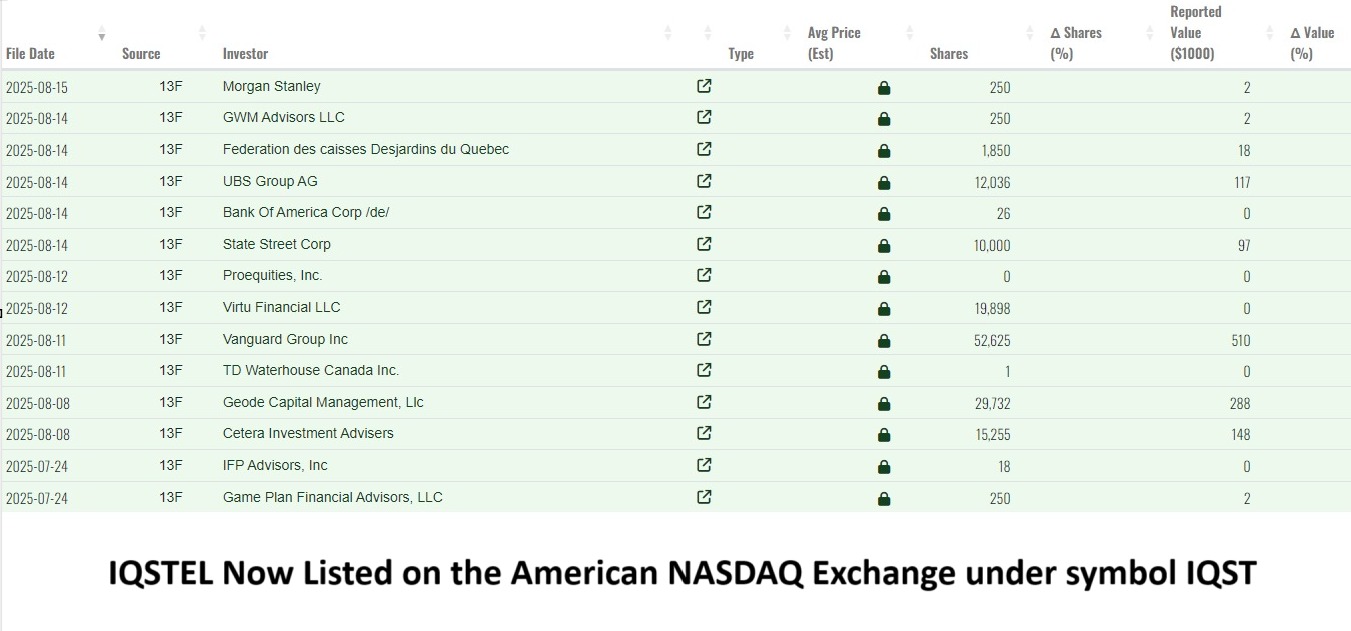

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on TelAve News

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on TelAve News

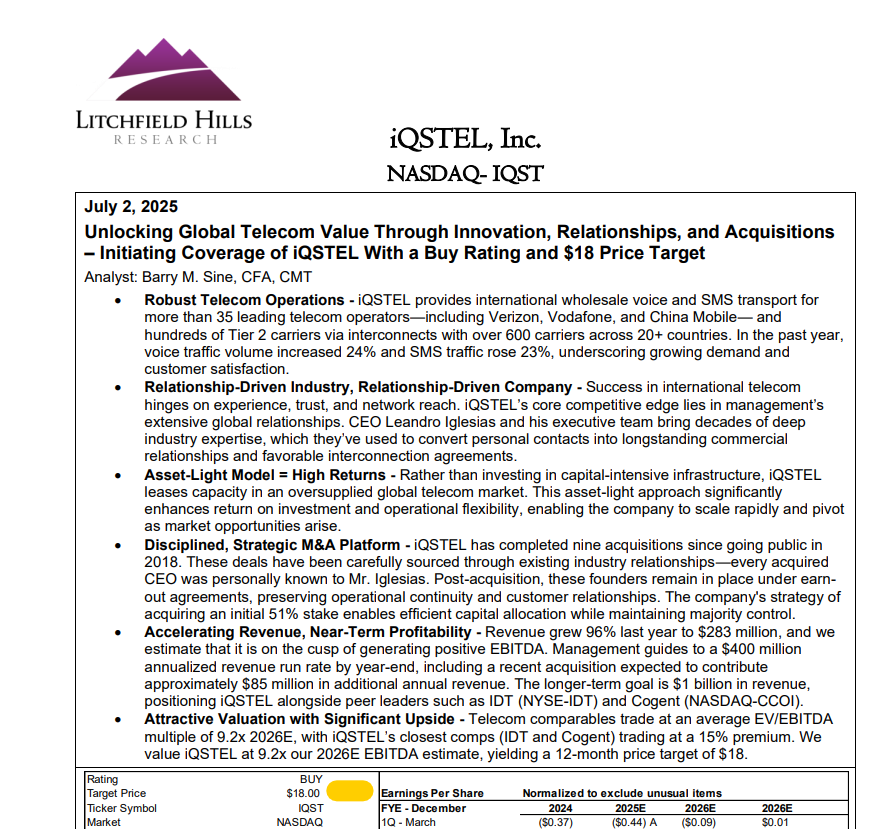

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on TelAve News

- New Frontier Aerospace Appoints Industry Veteran Rich Pournelle as Director of Business Development

- AI's Urgent Energy Requirements Won't Be Solved By Trillions Of Dollars. Phinge's Patented App-Less Netverse Platform & Hardware Will Reduce This Need

- $750 Million Market Projected to Reach $3.35 Billion; Huge Opportunity for Superior Preservative-Free Ketamine Drug Treating Suicidal Depression $NRXP

- €6.4 Million in Contracts Across Multiple Countries; Smart City Developer; U.S. Expansion, and Announces Strategic Drone Tech Partnership; $AFFU

- CRYPTOCURRENCY: Lucrumia Exchange Platform Addresses Italian Traders' Growing Demand for Secure Digital Asset Trading

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on TelAve News

- NIUFO Launches Secure Trading Platform for Italian Market Seeking Stability After 20% User Decline

- OrderDomains.com Empowers Businesses with Premium Domains and Flexible Financing

- Cryptocurrency Trading: AHRFD Enters German Market with Institutional-Grade Infrastructure

- TSWHZC Launches Automated Copy Trading Platform for Brazil's 28 Million Crypto Users

- Keyanb Crypto Exchange Unveils Comprehensive Platform Architecture for Chilean Traders Seeking Lower Fees and Enhanced Security

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology, Telecom, Stocks, Financial, Artificial Intelligence, Cybersecurity

0 Comments

Latest on TelAve News

- The World's No.1 Superstar™ Unveils Fall Lineup With the Re-Release of Holiday Classics

- Building A Business Website That Works In 2025

- The Law Offices of Steinhardt, Siskind and Lieberman, LLC Celebrates 35 Years

- University of Central Florida: "Psychiatry: An Industry of Death" Traveling Exhibit Educates Students on Mental Health Abuse

- LA's Rich & Successful Film Festival Celebrates Sold-Out Fourth Annual Edition

- New Jersey Therapy & Life Coaching Launches "Four Paws, Big Hearts" Fundraiser for Canine Companions

- AGDS Announces ALICE360 ProView EVO™

- Crossroads4Hope to Host Inspiring Hope Gala October 8, 2025

- LEDI Announces 2025 International Life Changers Awards Gala

- Who Will Win the 2025 Video Game of the Year? Bookmakers Review Shares Latest Odds

- International Gaming Platform Launch and Plans to Acquire Racing Women LTD. for AI Powered Sports, Entertainment and Gaming Leader: SEGG Media: $SEGG

- FDA Approval of Suitability Petition on Preservative-Free Ketamine Drug Supports $40 Analyst Target; $3 Billion Suicidal Depression Market: $NRXP

- U.S. Army Orders and Grant Initiative; Key Presentations at Tough Stump Rodeo & Tactical Assault Kit Events for Powerful Video Compression Tech: $RMXI

- Cervey, LLC and PharmaCentra, LLC Announce Strategic Partnership to Expand Pharmacy Technology Support Across Specialty Pharmacy and PBM Services

- Boston Industrial Solutions Introduces Natron® UVPX Series UV-LED Curing Screen Printing Inks

- OddsTrader Releases Latest NBA Finals Odds: Who's the Best Bet to Win in 2026?

- Planetary Constitution Celebrates First Anniversary as Space Policy Shifts Toward Militarization

- DB Landscape Co. Brings Modern Outdoor Living to Coastal Communities

- Alyrica Networks & Rural Prosperity Partners Secure Preliminary BEAD Award for Central Linn SD

- KeysCaribbean Offers 15 Percent Off Luxury Accommodations With Advance Purchase Rate Discount